Solana Current Price and Volume: What Trading Activity Tells You

Introduction: Why Volume Matters

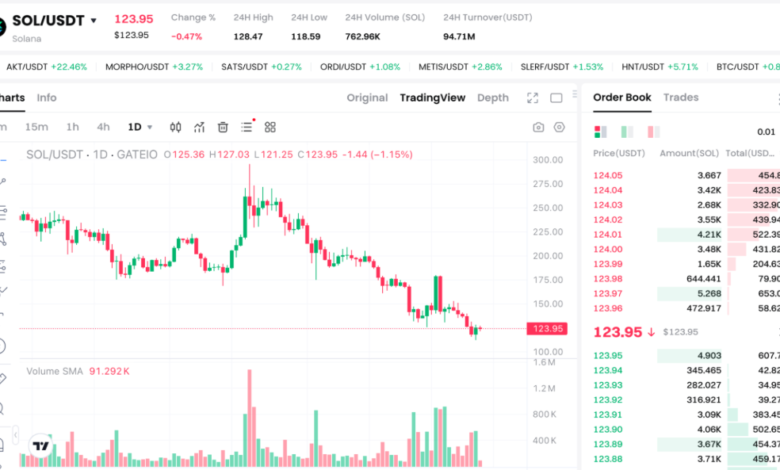

Many beginners focus only on the solana current price, but price alone does not tell the full story. Trading volume is one of the most important indicators for understanding whether a price move is strong, weak, or misleading.

Volume shows how much SOL is being traded within a specific time period. When price and volume are analyzed together, they provide clearer insight into market behavior.

What Is Trading Volume in Solana?

Simple Definition

Trading volume refers to the total number of SOL tokens bought and sold during a given timeframe, such as:

- 1 hour

- 24 hours

- 7 days

High volume means many participants are active. Low volume means fewer traders are involved.

Where Volume Data Comes From

Volume is calculated using transaction data from cryptocurrency exchanges and aggregated by tracking platforms.

Relationship Between Solana Current Price and Volume

Price Increase with High Volume

When the solana current price rises alongside high volume, it usually signals:

- Strong buyer interest

- Genuine market confidence

- A more reliable price movement

This type of price action is often considered healthy.

Price Increase with Low Volume

If price rises but volume is low:

- Fewer buyers are involved

- The move may be temporary

- Risk of reversal is higher

Volume helps confirm whether a trend is sustainable.

Falling Solana Current Price and Volume Signals

Price Drop with High Volume

A falling solana current price combined with high volume suggests:

- Strong selling pressure

- Fear or negative sentiment

- Possible continuation of a downtrend

Price Drop with Low Volume

This may indicate:

- Weak selling interest

- A temporary pullback

- Potential price stabilization

Volume Spikes and What They Mean

Sudden Increase in Volume

Volume spikes often occur due to:

- Major news announcements

- Market breakouts or breakdowns

- Large investor (whale) activity

These spikes usually precede or confirm major moves in the solana current price.

Volume Climax

Extremely high volume after a long trend can sometimes signal:

- Market exhaustion

- Possible trend reversal

How Beginners Should Use Volume

Confirming Trends

Always ask:

- Is volume increasing with price movement?

- Is the trend supported by participation?

If volume supports the trend, the solana current price movement is more trustworthy.

Avoiding False Signals

Low-volume price changes can be misleading. Volume helps filter out noise and emotional market reactions.

Common Volume Mistakes to Avoid

Ignoring Volume Completely

Relying only on price can lead to false conclusions.

Comparing Different Timeframes Incorrectly

Volume should always be analyzed on the same timeframe as price.

Best Places to Track Solana Volume

You can view reliable volume data alongside the solana current price on:

- CoinMarketCap

- CoinGecko

- TradingView

- Major crypto exchanges

For verified data, visit https://www.tradingview.com.

Frequently Asked Questions (FAQs)

1. Does high volume always mean price will rise?

No, volume confirms activity, not direction.

2. Is low volume bad for solana current price?

Low volume means weaker participation, not necessarily negative price movement.

3. Can volume predict price changes?

It helps confirm trends but should not be used alone.

4. Why does volume spike suddenly?

News, breakouts, or large trades often cause spikes.

5. Should beginners track volume daily?

Yes, especially when analyzing short-term price movement.

6. Is volume more important than price?

Both are important and should be used together.

Conclusion

Trading volume adds depth to understanding the solana current price. While price shows value, volume shows conviction. By analyzing both together, beginners can better judge whether a price movement is strong, weak, or potentially misleading.